Qualified Charitable Distribution

If you are over 70-1/2, you may make a Qualified Charitable Distribution (QCD) from your IRA directly to the Pennsylvania Heritage Foundation. A QCD can help you reach your Required Minimum Distribution without having to pay income taxes on your donation.

Donation information is as follows:

Pennsylvania Heritage Foundation, 400 North Street, Harrisburg, PA 17120

The Foundation's tax identification number is 22-2456059.

Legacy Giving

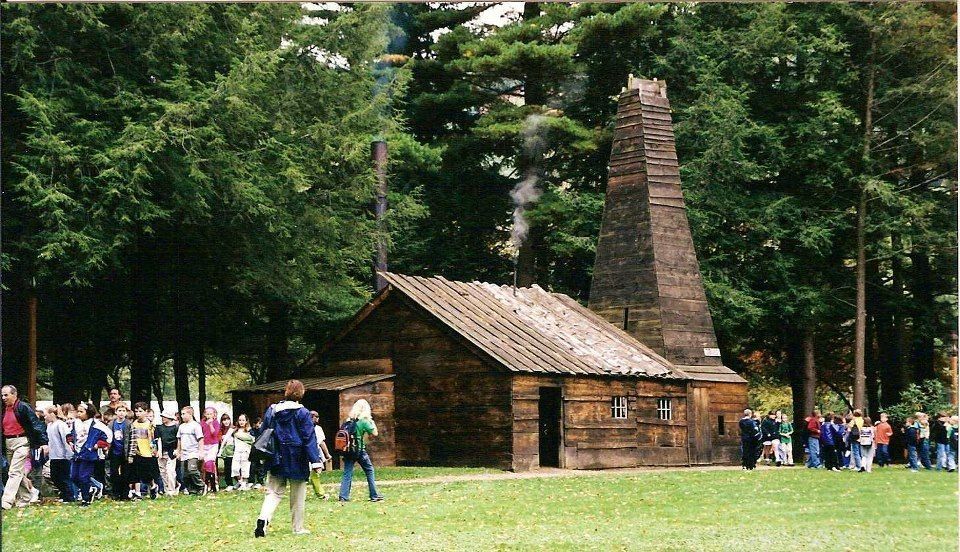

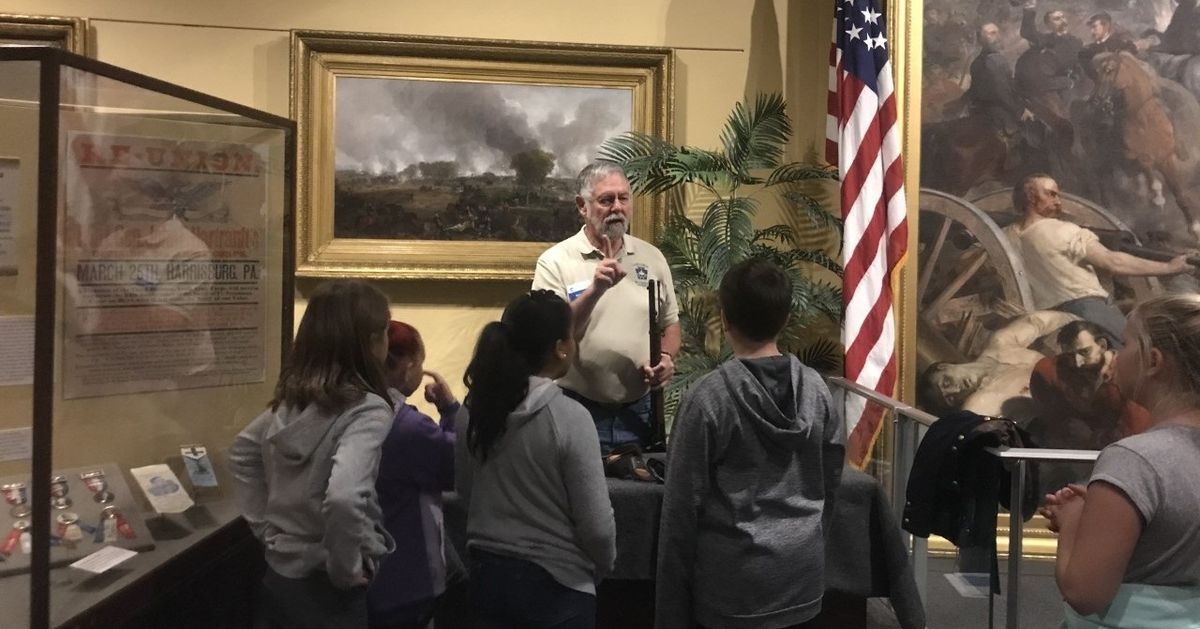

Please consider joining other Pennsylvanians to help ensure the history of our Commonwealth is passed on to future generations. A legacy gift, also known as a planned gift, costs you nothing now and can be changed at any time. The full value of the gifts described below can be transferred to the Pennsylvania Heritage Foundation without payment of federal or state taxes, because it is a 501c3 non-profit organization. Easy ways to do this are:

If the Pennsylvania Heritage Foundation is already a beneficiary of your retirement account, annuity, insurance policy or is in your will, THANK YOU! Notifying us of your intent to make a legacy gift to the Foundation would be greatly appreciated.

- Name the Pennsylvania Heritage Foundation as a Beneficiary of your IRA, 401(k), or 403(b) Retirement Account. To obtain a “Beneficiary Designation” form, call your account administrator (Fidelity, Vanguard, etc., or employer) or visit their website. Include “Pennsylvania Heritage Foundation, Tax ID 22-2456059” as either a Primary or Contingent Beneficiary. If Pennsylvania Heritage Foundation is one of several beneficiaries, specify a percentage of the account for each.

- Name the Pennsylvania Heritage Foundation as a Beneficiary of your Life Insurance Policy or Annuity. A “Beneficiary Designation” form is available by phone from your agent, the company (New York Life, Prudential, etc.) or the company’s website. Include “Pennsylvania Heritage Foundation, Tax ID 22-2456059” on the “Beneficiary Designation” form, specifying a dollar amount or percentage of the Policy for the Pennsylvania Heritage Foundation as well as any other beneficiaries.

- Leave a Bequest to the Pennsylvania Heritage Foundation through your will.

- If you are making a new will, ask your estate attorney to direct either a lump sum bequest or a residuary estate percentage to us. Be sure to give your lawyer the following, “Pennsylvania Heritage Foundation, Tax ID 22-2456059” for inclusion in the document.

- If you have a will and would just like to add us, ask your estate attorney to draft a codicil (an addition or amendment) to the will to include a bequest for the “Pennsylvania Heritage Foundation, Tax ID 22-2456059”.

To learn more about legacy giving, please fill out the form below. A trained, experience volunteer consultant is available at no cost or obligation to discuss your possible legacy gift and its use with you. In all cases, the advice and counsel of one’s own legal and financial advisor should be sought.

All conversations will be held in the strictest confidence.